So I was thinking about how staking rewards on Solana have really changed the game for everyday users. Honestly, it’s kind of wild how easy it’s gotten to earn passive income just by locking up tokens. But here’s the thing — the ecosystem’s growth has also made security a little trickier. I mean, if you’re messing with DeFi protocols, the risks can pile up quick.

Really? Yeah, seriously. At first, I thought staking was just about tossing your tokens into a pool and waiting. But then I dug deeper and realized there’s a whole dance involving validator selection, lock-up periods, and rewards compounding strategies. And if you’re not careful with your wallet setup, you could be exposing yourself to hacks or phishing scams.

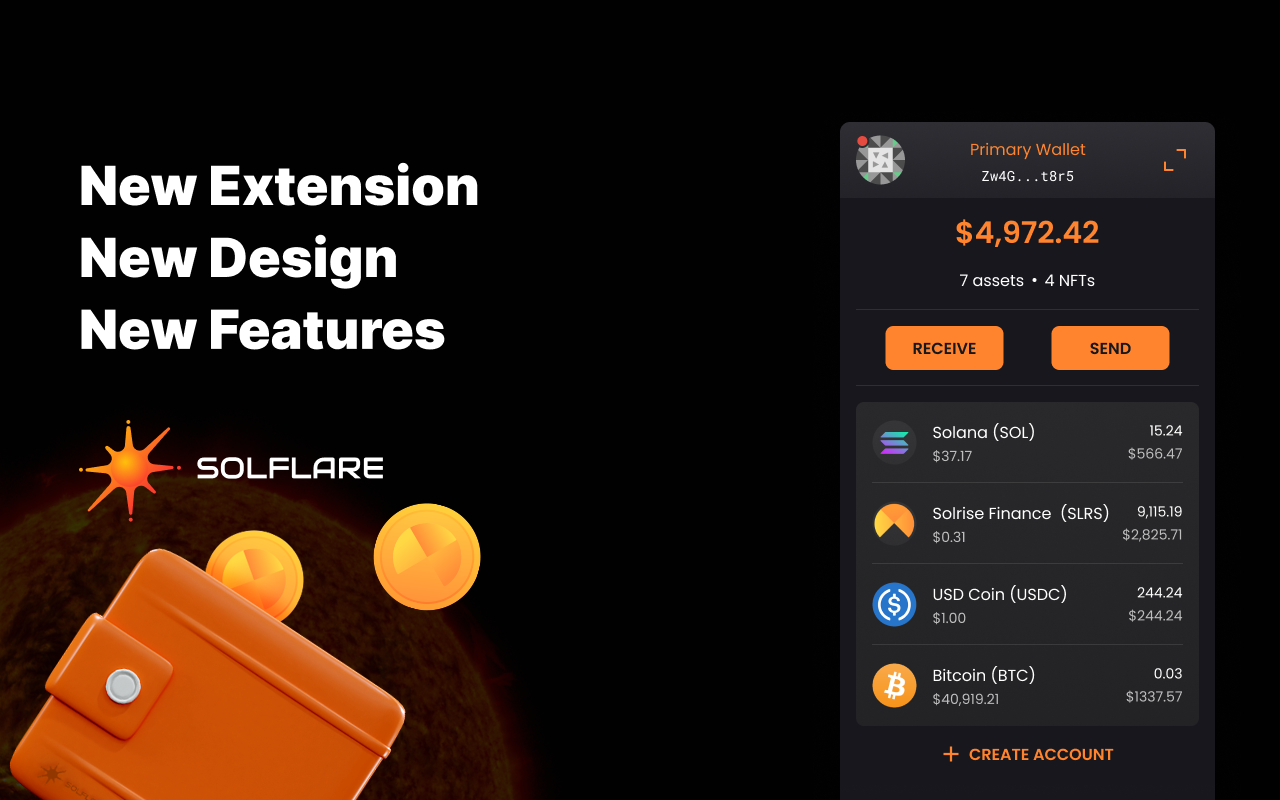

Whoa! That’s when I stumbled upon the solflare wallet. It felt like the missing puzzle piece — a user-friendly interface combined with hardware wallet support for that extra layer of security. Honestly, I’m biased, but it’s pretty slick how it integrates seamlessly with Solana’s DeFi apps while keeping private keys offline.

Here’s the thing. Managing staking rewards is not just about stacking tokens. If you’re actively involved in DeFi, you sometimes want to move your assets quickly, or reinvest rewards without waiting for unstaking delays. That’s where hardware wallets shine — they give you control without sacrificing security, especially when interacting with complex protocols.

Hmm… I remember when I first tried to stake using a software-only wallet. It was fine until I realized that signing multiple transactions left me vulnerable. Using a hardware wallet with the solflare wallet extension gave me peace of mind. It’s like having a vault for your keys, but still easy to use.

Okay, so check this out — staking rewards on Solana typically range around 6-8% annual yield, depending on the validator and network conditions. Sounds decent, right? But what bugs me is how some newer DeFi protocols promise crazy returns that just look too good to be true. My gut says tread carefully because not all yield farming is sustainable.

On one hand, staking feels like a straightforward way to grow your portfolio. On the other hand, if you dive into DeFi liquidity pools, you’re juggling impermanent loss, smart contract risks, and sometimes obscure tokenomics. Initially I thought you could just stake and chill, but actually, it’s a constant balancing act to maximize rewards while minimizing exposure.

Really, it’s a bit like riding a roller coaster blindfolded. You want the thrill of high returns, but without the stomach drop from unexpected losses. That’s why I always recommend combining staking with hardware wallet protection. It’s a safeguard against the “oh no” moments, especially when you’re interacting with multiple dApps on Solana.

Here’s something else I learned — not all hardware wallets play nice with Solana’s ecosystem out of the box. The solflare wallet extension bridges that gap nicely. It supports Ledger devices seamlessly and even helps you manage staking and DeFi transactions without jumping through hoops. Honestly, that made me rethink how accessible secure staking can be.

Check this out — the interface is clean, not overwhelming, which is huge for folks who aren’t hardcore coders or crypto veterans. I’m not 100% sure about some advanced features yet, but the core staking and wallet integration just works. Plus, it’s US-friendly, meaning it respects local regulations better than some fly-by-night apps.

So yeah, if you’re in the Solana ecosystem and want to stake your tokens or get into DeFi with some confidence, pairing your assets with a hardware wallet via the solflare wallet is a solid move. It’s like having your cake and eating it too — rewards and security.

But wait, here’s a curveball. What about the fees? Solana’s fees are famously low, like fractions of a cent, but when you’re staking or moving assets between protocols, those tiny fees can add up. That’s especially true if you’re frequently compounding rewards or rebalancing your portfolio. So, while staking is attractive, I always wonder if the extra transactions are worth the marginal gains.

Hmm… My instinct says it depends on your strategy. If you’re in for the long haul and staking steady with a reliable validator, fees won’t eat much of your returns. But if you’re hopping between DeFi pools chasing the latest yield farm, you might find yourself paying more in fees than you earn in rewards sometimes. That’s where the solflare wallet helps again — by providing clear fee estimates and smooth transaction management.

Honestly, I’ve had moments where I felt the DeFi landscape on Solana was a bit like the wild west — exciting but unpredictable. Hardware wallets don’t solve all problems, but they sure reduce the risk of losing everything to a phishing attack or compromised private keys. And for US users, that peace of mind is very very important.

So, to wrap up my wandering thoughts here — staking rewards on Solana are a compelling way to grow crypto holdings, but they come with nuanced trade-offs in security and transaction management. Using a hardware wallet combined with a robust interface like the solflare wallet extension strikes a balance that feels right for me.

I’m curious though — as the Solana ecosystem evolves, will wallet providers keep pace with emerging DeFi complexities? Probably, but it’s a moving target. (Oh, and by the way, if you’re just getting started, take your time. Don’t rush into staking or DeFi without understanding what’s under the hood.)

Anyway, the whole experience feels like stepping into a brave new world where tech, finance, and security collide. And I’m here for the ride, even if sometimes it’s bumpy and a bit confusing.